📊 Quantamental Trading Approach

Quantamental is a new trading approach that combines quantitative and fundamental analyses to forecast future market conditions. Trading and data mining are expected to converge in the near future.

In general, forecasting is the process of predicting future market conditions based on past and present data, as well as the analysis of key trends. All forecasting methods can be divided into two broad categories:

(i) Quantitative methods, based on mathematical models, and

(ii) Qualitative methods, based on educated guessing.

(1) Quantitative Forecasting

(2) Fundamental Analysis

Fundamental analysis is a method of valuing a financial instrument by examining and evaluating all relevant internal and external factors. These factors include financial, economic, social, political, strategic, and other quantitative and qualitative variables. The goal of fundamental analysis is to determine a 'fair value' that can be compared with the current market price.

Fundamental analysis uses a wide range of real data—such as macroeconomic indicators, industry analysis, balance sheets, earnings reports, and key data releases—to assess the value of a financial instrument.

While fundamental and quantitative analyses differ in core ways, they also share many similarities. For example, when evaluating shares, both methods consider market capitalization, sector classification, price/earnings ratio, and dividend policy. As a result, quantitative models can be used to optimize the outcomes of fundamental analysis.

(3) Combining Quantitative Forecasting and Fundamental Analysis (Quantamental Analysis)

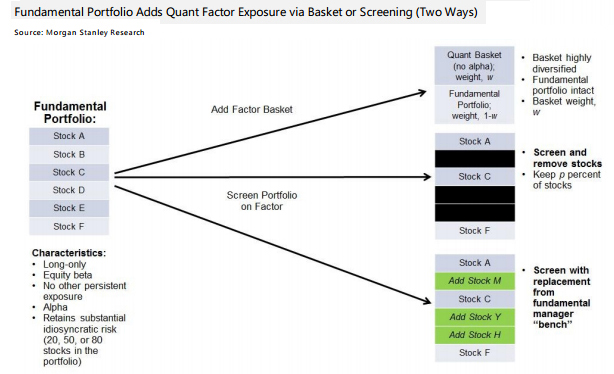

The Quantamental method combines the computational power of algorithms with the human ability to adapt to new market conditions. Quantamental investors blend the focus on specific market strengths and weaknesses (fundamental analysis) with the large data sets and computational skills of the quantitative approach. This allows them to target any area of a broad market and effectively test their hypotheses.

Quantamental's analysis advantages include:

-1- Combining computer power with native human abilities

-2- Adapting fast to any new market conditions (a common phenomenon in finance)

-3- Testing any fundamental hypothesis using long historical data series

-4- Being able to combine the short and mid-term skills of the quantitative method with the long-run horizon of the fundamental analysis

-5- Filtering and arranging any new recognizable pattern

-6- Taking advantage of the massive data available on the internet

-7- Achieving innovation, and at the same time, data optimization

-8- Differentiating results against other investors using common fundamental models

The Quantamental approach is becoming very popular based on today's availability of alternative data. Alternative data include data from social media and broader from our new cyber world.

♞ StrategyQuant: Trading Strategy Building

StrategyQuant users can create or access pre-built automated strategies to trade in any financial market (Forex, Equities, Metals, Soft Commodities, etc.). The only requirement for the trader is to select a market and a timeframe. StrategyQuant then begins generating automated strategies. The trader can choose the ones with the best performance and further test and optimize them against randomness.

StrategyQuant users can create or access pre-built automated strategies to trade in any financial market (Forex, Equities, Metals, Soft Commodities, etc.). The only requirement for the trader is to select a market and a timeframe. StrategyQuant then begins generating automated strategies. The trader can choose the ones with the best performance and further test and optimize them against randomness.

□ StrategyQuant operates in four (4) modes: building, re-testing, improvement, and optimization

□ Building (from scratch) and optimizing automated trading systems for every financial market

□ Generating and testing thousands of random automated strategies (within hours)

□ Applying automated data-mining algorithms to generate EAs for MetaTrader4, TradeStation, and NinjaTrader platforms

□ 14-day trial (The StrategyQuant trial version is fully functional and it is not limited compared to the full package. The trial includes also data from EUR/USD, USD/CHF, GBP/USD, and USD/JPY).

These are some key features of the platform:

- Find easily thousands of automated strategies trading currencies, stocks, derivatives, etc.

- Multi-currency backtesting

- Create EAs for MetaTrader 4, TradeStation, NinjaTrader, and MultiCharts without programming skills

- Walk-Forward Optimization, Walk-Forward Matrix (3d Charts), and Monte Carlo methods

- Random strategy generation (avoid curve fitting)

- Advanced backtesting and optimization modules (External tick-data support)

🔗 Read More: ► Review StrategyQuant | ► Start your free 14-day trial here

■ Quantamental Trading Approach

ForexRobots.net (c)

![]()

Read More at ForexRobots.net